By FocusEconomics

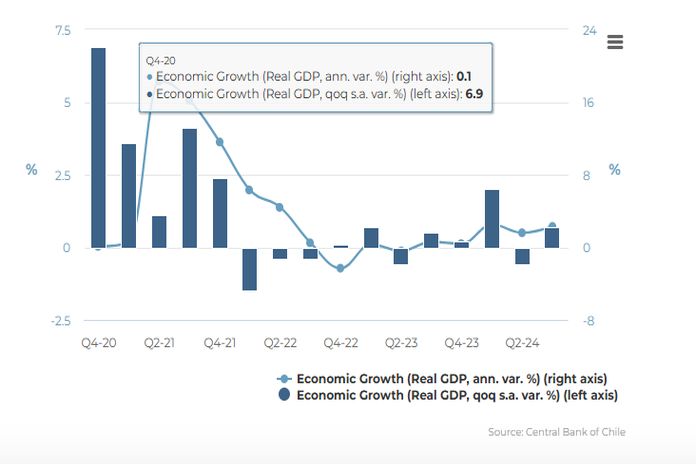

GDP reading: GDP increased 0.7 percent on a seasonally adjusted quarter-on-quarter basis in the third quarter, contrasting the 0.6 percent contraction recorded in the second quarter. The rebound was linked to recoveries in private and public spending. On an annual basis, economic growth improved to 2.3 percent in Q3, following the previous quarter’s 1.6 percent growth.

Improved consumption outweighs weaker external sector

Household spending increased 0.1 percent in the third quarter, which contrasted the second quarter’s 0.4 percent contraction. Public spending rebounded, growing 1.0 percent in Q3 (Q2: -1.5% s.a. qoq). Meanwhile, fixed investment growth moderated to 1.2 percent in Q3, below the 1.7 percent increase recorded in the prior quarter. Exports of goods and services growth fell to 1.7 percent in Q3 (Q2: +2.4% s.a. qoq). Conversely, imports of goods and services bounced back, rising 1.8 percent in Q3 (Q2: -0.4% s.a. qoq).

Slowdown expected ahead: Our Consensus is for a softer rate of quarter-on-quarter GDP growth in Q4 vs Q3.

Panelist insight: On risks to the outlook, EIU analysts, said:

“The greater than anticipated win for Trump has raised the risk that his more hardline trade policies will be pursued. His proposals have included a potential blanket tariff of up to 20 percent on imports to the US. If this tariff applied to Chile, which is possible, it would weigh on Chilean exports and overall growth. Furthermore, Trump’s threat to impose high tariffs on China risks slowing growth in that country, which is the largest destination for Chilean goods.

“Domestically, the upcoming presidential election, which is scheduled for November 2025, will keep business confidence in pessimistic territory for much of next year; we expect the election to prompt a wait-and-see approach to major investment decisions.”