Thomas Festerling, CEO of Greentec Capital, Germany, Achumboro Ataande, Angel Investor and CEO of Attaande and Advisors, USA, Mia von Koschitzky–Kimani, Managing Partner of Future Africa, Nigeria and Rodrique Msechu, CEO of Serengeti Angels, Tanzania would consititute the Angel Investors Panel moderated by Abigail Komu of Nairobi Business Angel Network (NaiBAN), Kenya on the first day of the 11th Angel Fair Africa aka AFA at OneSpace in the TRIFIC North Towert at Two Rivers in Nairobi, Kenya. The panelists would share their invaluable experiences of investing in African founders with their unique perspectives.

The entrepreneur’s panel of the day would feature; Isidore Kpotufe of Rivia, Chisepo Chirwa of Bosso, both of whom pitched at last year’s event in Cape Town, and raised in record time, Hilda Moraa of Pezesha and Chidi Okpala of Asante Group who also raised this year, moderated by Micheline Ntiru of Delta40. They would be sharing their respective experiences of raising within the funding winter of the last three years in Afrcia.

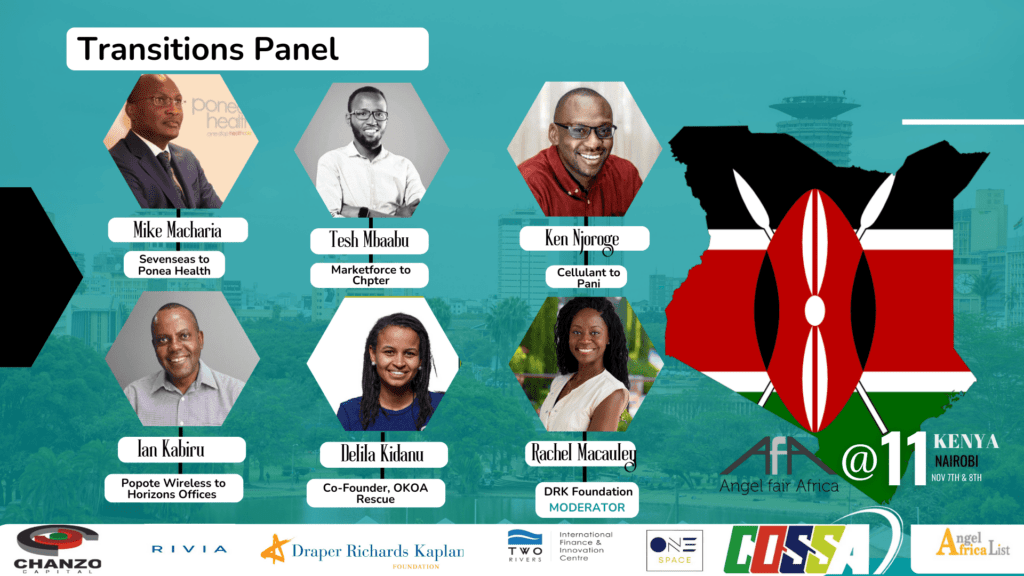

For the first time, AFA is introducing a “Transitions Panel” which would feature founders who have transitioned from one venture to another sharing their experiences from the former venture whether it failed or still going. What they learnt from that venture and how they are applying that experience to the new venture. They would also share nuggests on their personal journey as founders in areas like mental health of a founder, etc.

“We are excited to welcome these amazing investors and founders to AFA@11 – am particularly looking forward to hearing the stories from the transitions panel” said Winnie Kimathi, AFA Lead at Chanzo Capital.

On his part, Nick Vilelle, founding member of NaiBAN said “the funding winter has been challenging but AFA is bringing things up again and we are glad to be partners for this year’s event in the Silicon Savannnah of Kenya”

Diana Gichaga of Private Equity Support indicated that “it is an honor to be facilitating the engagement between the founders and investors through managing the deal room at AFA@11”.